All about Simply Solar Illinois

Wiki Article

Simply Solar Illinois Can Be Fun For Anyone

Table of ContentsSome Known Incorrect Statements About Simply Solar Illinois Excitement About Simply Solar IllinoisIndicators on Simply Solar Illinois You Need To KnowGetting My Simply Solar Illinois To Work3 Easy Facts About Simply Solar Illinois Shown

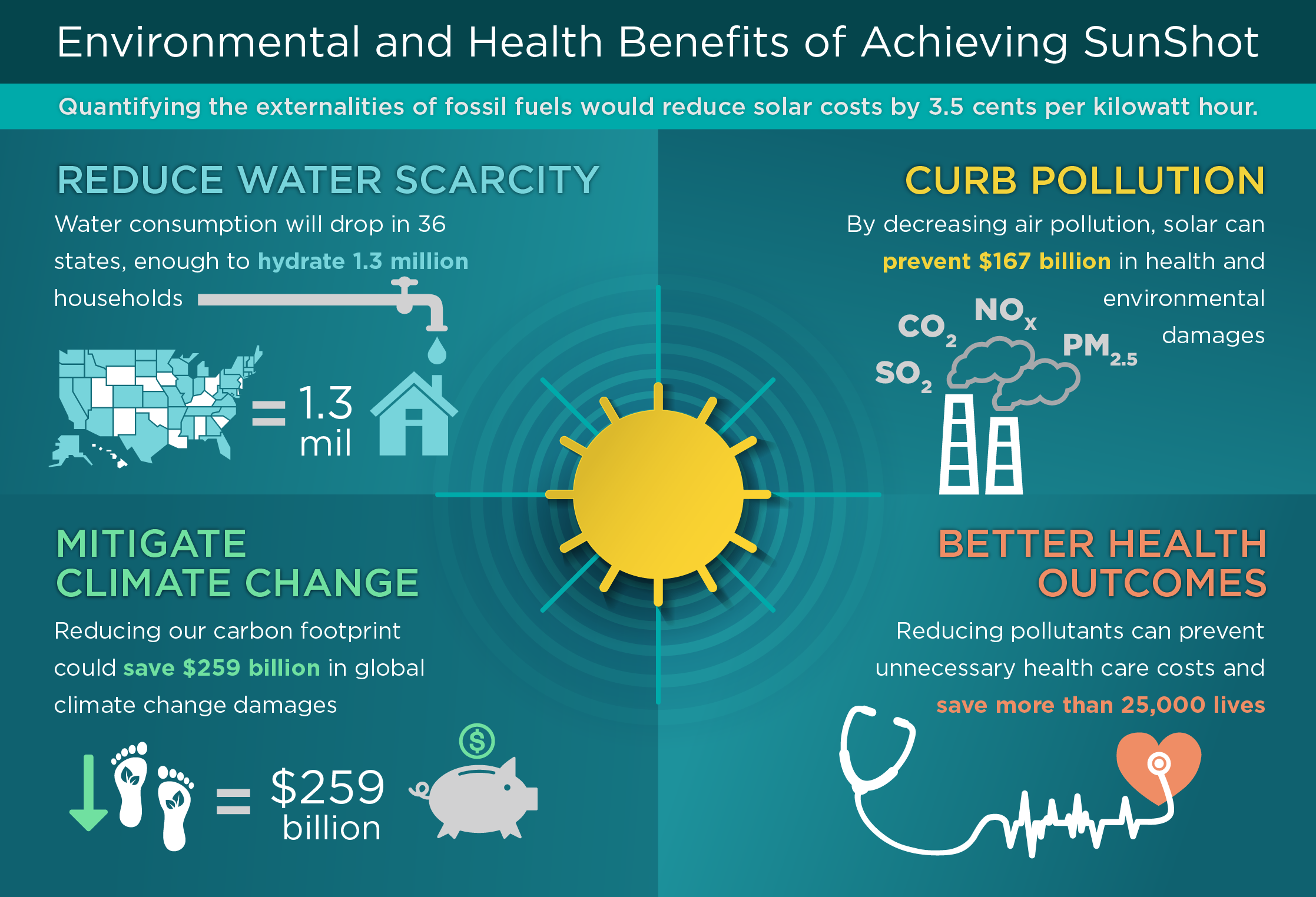

Our group companions with regional areas throughout the Northeast and beyond to provide clean, affordable and dependable power to foster healthy areas and maintain the lights on. A solar or storage project supplies a number of advantages to the community it offers. As modern technology breakthroughs and the expense of solar and storage decline, the economic advantages of going solar remain to rise.Assistance for pollinator-friendly environment Habitat restoration on infected sites like brownfields and land fills Much required shade for animals like lamb and chicken "Land financial" for future farming usage and soil quality improvements As a result of climate change, severe weather is coming to be much more constant and disruptive. Therefore, house owners, companies, areas, and utilities are all coming to be much more and extra thinking about safeguarding energy supply options that offer resiliency and energy protection.

Environmental sustainability is an additional key driver for organizations buying solar power. Numerous companies have robust sustainability objectives that consist of minimizing greenhouse gas exhausts and using less sources to help reduce their influence on the natural environment. There is a growing urgency to attend to climate modification and the stress from consumers, is reaching the top degrees of organizations.

The Ultimate Guide To Simply Solar Illinois

As we come close to 2025, the combination of photovoltaic panels in business projects is no more simply a choice but a critical need. This blogpost explores how solar power works and the multifaceted benefits it offers commercial buildings. Photovoltaic panel have been made use of on property structures for years, however it's just recently that they're coming to be more usual in industrial building and construction.

In this short article we discuss just how solar panels job and the benefits of making use of solar power in business structures. Electricity costs in the U.S. are increasing, making it extra expensive for businesses to operate and extra difficult to intend ahead.

The U - Simply Solar Illinois.S. Power Info Administration anticipates electric generation from solar to be the leading resource of development in the U.S. power sector through the end of 2025, with 79 GW of brand-new solar capacity projected to come online over the next 2 years. In the EIA's Short-Term Energy Expectation, the firm stated it anticipates eco-friendly energy's total share of electricity generation to increase to 26% by the end of 2025

The Single Strategy To Use For Simply Solar Illinois

The photovoltaic solar cell takes in solar radiation. The cables feed this DC electrical power right into the solar inverter and transform it to alternating power (AIR CONDITIONER).There are a number of means to store solar energy: When solar power is fed into an electrochemical battery, the chemical response on the battery parts maintains the solar power. In a reverse response, the present leaves from the battery storage for consumption. Thermal storage makes use of tools such as molten salt or water to retain and take in the warm from the sun.

This system stores pressed air in huge vessels such as storage tanks or natural developments (e.g., caverns), then releases the air to create power. Electrical energy is among the biggest recurring expenditures that industrial buildings have. Photovoltaic panel webpage substantially decrease energy prices. While the preliminary investment can be high, overtime the price of setting up solar panels is redeemed by the cash reduced power costs.

How Simply Solar Illinois can Save You Time, Stress, and Money.

By setting up solar panels, a brand name shows that it respects the setting and is making an effort to reduce its carbon footprint. Buildings that depend entirely on electrical grids are vulnerable to power blackouts that take place during negative weather condition or electrical system malfunctions. Photovoltaic panel set up with battery systems permit industrial structures to continue to operate during power interruptions.

Getting The Simply Solar Illinois To Work

Solar power site link is among the cleanest forms of power. With lasting service warranties and a production life of up to 40-50 years, solar investments add considerably to ecological sustainability. This shift in the direction of cleaner energy resources can lead to wider economic benefits, consisting of reduced environment change and environmental destruction costs. In 2024, house owners can benefit from federal solar tax obligation rewards, permitting them to offset almost one-third of the acquisition price of a planetary system via a 30% tax credit.Report this wiki page